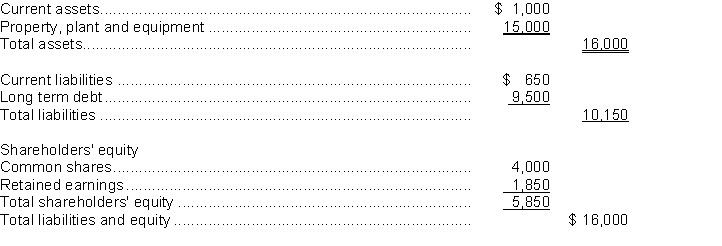

The following is a summarized balance sheet of Falcon Corporation at December 31, 2013. All amounts are in $000's.  Falcon requires additional financing of $5,000,000 to finance an expansion of its business. The two choices are:

Falcon requires additional financing of $5,000,000 to finance an expansion of its business. The two choices are:

Alternative 1: Issue a 20-year, $5,000,000 5% bond payable at face value.

Alternative 2: Issue 250,000 common shares at $20 each.

In Falcon's industry, a safe debt to total assets ratio is considered to be between 50% and 60%. Falcon's board of directors is risk adverse. Assume that the financing is made at the beginning of the year.

Instructions

a. Calculate the debt to total assets ratio under the two proposed financing methods.

b. Make a recommendation to Falcon on the better financing alternative and explain your choice.

Definitions:

Supply

The sum of a good or service that is offered for sale at a particular price point within a specific market.

Consumers' Incomes

The total amount of money received by individuals or households, influencing their purchasing power and consumption patterns.

Computer Chips

Small electronic components made of semiconductor material, used to perform computing tasks and store data in various electronic devices.

Supply Curve

A graph showing the relationship between the price of a good and the quantity supplied, typically illustrating that as the price increases, the quantity supplied increases.

Q2: One of the differences between notes payable

Q71: What is the correct journal entry

Q103: If bonds with a face value of

Q114: The Interest coverage ratio indicates the company's

Q119: During its first year of operations, Millwoods

Q120: Comparative information taken from the London

Q129: Retained earnings are subtracted from share capital

Q136: Which of the following is NOT a

Q138: Which one of the following affects cash

Q142: If a company is a start-up company,