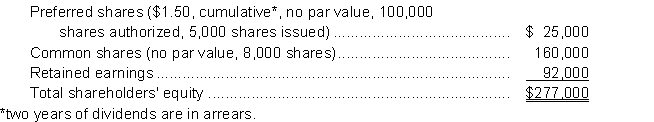

Oswala Inc. had the following balances in its shareholders' equity at the beginning of the current year (January 1, 2014):  During the year ended December 31, 2014, the following transactions took place:

During the year ended December 31, 2014, the following transactions took place:

1. On January 1, issued 9,000 common shares at $18 per share.

2. On July 1, declared a 10% stock dividend on the common shares, market price $18.50 per share. The dividend is to be paid on August 15 to shareholders of record on July 31.

3. On August 15, the company paid the stock dividend.

4. On September 15, Ryder's board of directors declared a 4-for-1 stock split.

During the year, the company had a profit of $85,000.

Instructions

a. Prepare the journal entries to record the above transactions. Closing entries are not required.

b. Prepare a statement of changes in shareholders' equity for 2014.

c. Prepare the shareholders' equity section of the balance sheet at December 31, 2014.

Definitions:

Mortgage Notes Payable

A liability represented by a legal document indicating the amount owed on a mortgage, including terms for repayment and interest rates.

Financing Activity

Transactions related to raising capital and repaying investors, including issuing equity, taking out loans, and distributing dividends.

Cash Receipts

The total amount of money received by a business during a specific period, including cash sales, collected receivables, and any other cash inflows.

Statement Of Cash Flows

A financial statement that consolidates information about all the money a company gets from its regular operations and outside investments, alongside the money spent on business operations and investments within a certain timeframe.

Q13: DEN, Inc. has 1,000, $6, cumulative preferred

Q14: Westcock Shipbuilding Ltd. has a December 31

Q27: The balance sheets and income statements for

Q43: Dividends are declared out of<br>A) Contributed Capital.<br>B)

Q64: A partner pays income tax on the

Q78: If goods are shipped FOB destination then

Q79: Prior period adjustments should be made for

Q86: A factor which distinguishes the corporate form

Q92: Under IFRS the following account is included

Q115: Faithful representation means that accounting information reports