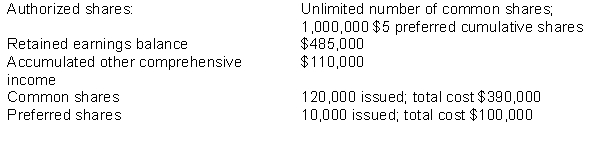

On January 1, 2014, the following information appears in the records of Boultin Holdings Inc.:  During the year, the company had the following transactions:

During the year, the company had the following transactions:

Mar 31 Declared cash dividends on common shares of $0.50 per share; payable to shareholders of record on April 10, and payable on April 25.

Jun 30 Declared the entire annual dividend required on preferred shares; payable to shareholders of record on July 15, and payable on July 31.

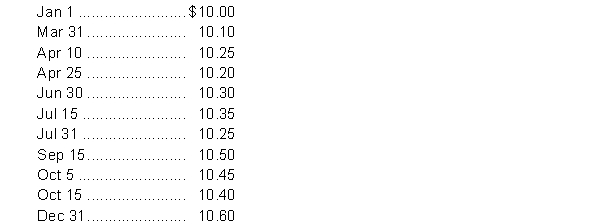

Sep 15 Declared a 10% stock dividend to shareholders of record on October 5, and distributable on October 15.

All dividends were paid or distributed on the due date.

Market price of Boultin's common shares at various dates was as follows:  At December 31, 2014 the accounting records indicate that Boultin's profit for 2014 was $350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $28,000.

At December 31, 2014 the accounting records indicate that Boultin's profit for 2014 was $350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $28,000.

Instructions

a. Journalize the dividend transactions.

b. Prepare the statement of changes in shareholders equity for the year ended December 31, 2014.

c. Prepare the shareholders' equity section of Boultin's balance sheet at December 31, 2014.

Definitions:

Impasse

A deadlock or stalemate reached during negotiations where both sides are unable to resolve differences and move forward, often leading to a halt in discussions until conditions change.

Mainstream Industrial Relations

Pertains to the conventional study and practice of the relationship between employers, workers, and the government including trade unions and collective bargaining.

Employment Relationship

The formal or informal contract between an employer and employee, defining mutual rights, responsibilities, and expectations.

Conflicting Interests

Situations where the goals, needs, or desires of involved parties interfere with one another, often a central aspect in negotiations and disputes.

Q31: Companies following ASPE are required to prepare

Q41: Partner A receives $60,000 and Partner B

Q43: Dividends are declared out of<br>A) Contributed Capital.<br>B)

Q73: The income statement of Meaney Inc.

Q74: When the percentage of completion method is

Q84: A partner contributes, as part of her

Q104: Accounting information is neutral if<br>A) it is

Q124: Significant investing and financing activities that do

Q133: All gains and losses from investing activities

Q160: The date at which ownership is determined