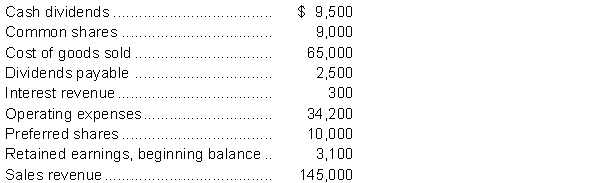

The following information is taken from the trial balance of GlaxonSmith Supplies Ltd. at December 31, 2014, the company's year end. GlaxonSmith has a 25% tax rate. One of the entries making up the balance of retained earnings is an adjustment that was required due to the overstatement of prior year's depreciation expense by $1,600 which is net of tax effect.  Instructions

Instructions

Prepare the income statement and statement of retained earnings for GlaxonSmith for the year ended December 31, 2014 using the multiple-step format for the income statement.

Definitions:

Substitute Check

A digital reproduction of an original check that legally substitutes for the original paper version for processing.

Paper Reproduction

Paper reproduction involves creating a copy or duplicate of a document using various methods, such as printing, photocopying, or scanning.

Legal Copy

Specifically prepared and reviewed text that meets requirements for legal accuracy and compliance, often used in contracts, agreements, and official documents.

Provisional Credit

Temporary credit issued by a bank to an account holder's account, pending investigation or finalization of a transaction.

Q4: When a company reacquires shares at a

Q11: As in a proprietorship, changes in capital

Q33: Mobile Corp. has other operating expenses of

Q33: If a corporation issued $4,000,000 in bonds

Q35: The amount of dividends paid is reported

Q50: Austrian Limited is a private corporation reporting

Q64: At the end of each accounting year,

Q74: As long as it is likely the

Q79: Income tax expense must be added on

Q112: The Jackson-Chan partnership is terminated when creditor