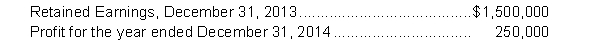

The following information is available for Reynolds Corporation:  The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2012 and 2013 using the double diminishing-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effect of the error on prior years was $9,000. Depreciation was calculated by the straight-line method in 2014. Reynolds' average tax rate is 22%. During 2014, Reynolds declared and paid cash dividends of $80,000.

Instructions

a. Calculate the impact on retained earnings.

b. Prepare the statement of retained earnings for 2014.

Definitions:

Polynomial

An algebraic expression consisting of variables and coefficients, combined only by addition, subtraction, multiplication, and non-negative integer exponents.

Greatest Common Factor

The highest number that divides exactly into two or more numbers without leaving a remainder.

Missing Factor

A value that, when multiplied with others, gives a specified result; often used in solving algebraic equations.

Greatest Common Factor

The largest number that divides two or more numbers without leaving a remainder.

Q9: When the discount on bonds is amortized,

Q22: At September 30, 2014, C. Saber and

Q38: Which statement below is NOT true?<br>A) The

Q60: Financial leverage refers to the practice of

Q61: $5 million, 5%, 10-year bonds are issued

Q61: The following are independent situations observed by

Q85: In calculating cash flows from operating activities

Q90: Under IFRS, there is a section in

Q134: Lee Holdings Ltd. was incorporated on January

Q165: The authorization of share capital does not