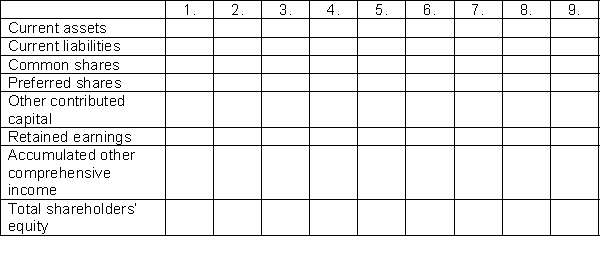

Connolly Corporation had the following events during one fiscal year:

1. A stock dividend is declared on common shares.

2. The stock dividend is distributed.

3. Other comprehensive income for the year totals $350,000.

4. Cash dividends are declared.

5. The cash dividends are paid.

6. Profit for the year is $1,500,000.

7. Prior year's profit had to be corrected to record additional revenue that had been earned, but which had not yet been paid for by the customer. The additional revenue increases the amount of taxes payable on the prior year's income.

8. Repurchased common shares for an amount less than their average cost.

9. One third of the preferred shares are converted to common shares on a 1:10 ratio.

Instructions

Using the table provided, for each of the following financial statement categories, indicate the effect of the transaction as follows:

Definitions:

Direct Labor Quantity Variance

This refers to the difference between the actual labor hours worked and the standard labor hours that should have been worked for the actual level of production, multiplied by the standard hourly wage rate.

Direct Labor Cost

The expense incurred by a company for wages, benefits, and other costs for employees who work directly on the manufacturing of products.

Produced

Refers to the quantity of goods or services created by a company during a specific time period.

Predetermined Overhead Rate

A rate calculated before a period begins, used to apply manufacturing overhead costs to products based on a specified activity base.

Q1: Warranty liabilities are estimated based on actual

Q16: An increase in a company's gross profit

Q22: If the market rate of interest is

Q23: Corporations generally issue stock dividends in order

Q47: When a company repurchases its shares but

Q54: A partner may only withdraw from a

Q63: To calculate earnings per share, preferred dividends

Q82: The entry to record the reacquisition of

Q91: Lazarus Ltd. had total operating expenses of

Q132: Issuing bonds for land is<br>A) reported in