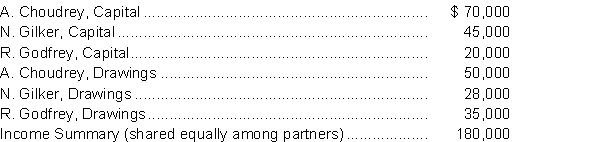

The following information is available regarding CGG Company's partnership accounts at December 31, 2014, before completion of the closing entries:  No new contributions were made during 2014. Godfrey wishes to withdraw from the partnership January 1, 2015.

No new contributions were made during 2014. Godfrey wishes to withdraw from the partnership January 1, 2015.

Instructions

a. Prepare the statement of partners' equity for the year ended December 31, 2014.

b. Prepare the January 1, 2015 entry to record Godfrey's withdrawal under each of the following three independent alternatives:

(i) Choudrey and Gilker each pay Godfrey $10,000 out of their personal accounts and each receives one half of Godfrey's equity.

(ii) Godfrey is paid $100,000 out of partnership cash.

(iii) Godfrey is paid $40,000 out of partnership cash.

Definitions:

Price Floor

A government- or authority-imposed minimum price that can be charged for a commodity, often set above the equilibrium price, leading to a potential surplus of the product.

Equilibrium Price

The price where the availability of goods in the market equates to the quantity desired by buyers.

Quantity Supplied

The total number of units of a good or service that sellers are willing and able to sell at a given price.

Price Ceiling

A price cap established by the government to regulate the maximum charge for goods, services, or commodities.

Q16: The following transactions occurred during 2014:<br>1. A

Q22: Retained earnings are always shown in before

Q36: The relationship of current assets to current

Q58: Corporation income tax expense is<br>A) usually accrued

Q59: Which of the following statements apply to

Q64: If 10,000 common shares were reacquired for

Q69: The authorized shares of a corporation<br>A) only

Q107: The liquidation of a partnership ends the

Q116: All of the following are normally found

Q134: In the withdrawal of a partner, a