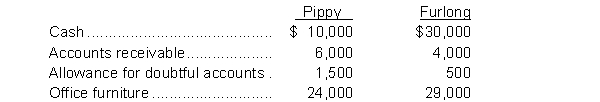

On January 1, 2013, Steve Furlong and Mark Pippy agreed to pool their assets and form a partnership called F&P Computing. They agree to share all profits equally and make the following initial investments:  On December 31, 2013, the partnership reported a loss for the year of $19,500. On January 1, 2014, Furlong and Pippy agreed to accept Nicholas Adams into the partnership by purchasing 20% of Pippy's interest in the partnership and 30% of Furlong's interest. The partnership agreement is amended to provide for the following sharing of profit and losses:

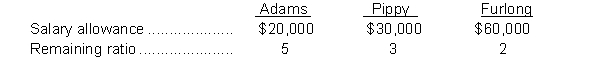

On December 31, 2013, the partnership reported a loss for the year of $19,500. On January 1, 2014, Furlong and Pippy agreed to accept Nicholas Adams into the partnership by purchasing 20% of Pippy's interest in the partnership and 30% of Furlong's interest. The partnership agreement is amended to provide for the following sharing of profit and losses:  For the year ended December 31, 2014, profit was $350,000.

For the year ended December 31, 2014, profit was $350,000.

Instructions

a. Journalize the following transactions:

(1) the initial contributions to the partnership by Furlong and Pippy on January 1, 2013.

(2) the allocation of the loss to the partners at the end of December 2013.

(3) the purchase of the partnership interest by Adams on January 1, 2014.

b. Prepare a schedule to show the division of profit at December 31, 2014.

Definitions:

Ethical Decision Making

The process of evaluating and choosing among alternatives in a manner consistent with ethical principles.

Managerial Decisions

The process by which managers select a course of action among several alternatives to achieve organizational goals.

Problem Seeker

An individual or entity that proactively looks for potential issues or challenges before they escalate, to address them early.

Anticipated Need

Expectation of a requirement or demand in the future, often based on current trends or forecasts.

Q3: A public corporation is a corporation that

Q9: The following is information taken from the

Q39: A mortgage note payable with a fixed

Q43: Not every country uses the same conceptual

Q52: For the year ended December 31, 2014,

Q89: Sam Kirby invests personally owned equipment, which

Q100: Shediac Bay Sailing Inc. sold $175,500 of

Q126: If convertible preferred shares are converted into

Q154: Prairie Airlines purchased a 747 aircraft on

Q180: Tam Corporation has 5,000 preferred shares that