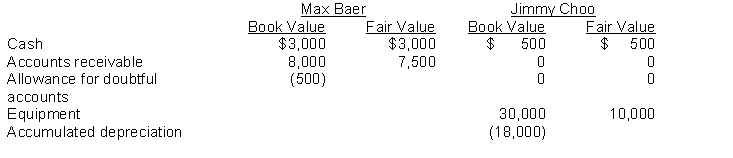

Max Baer and Jimmy Choo are two proprietors who decide to merge their businesses into a partnership on January 1, 2014. The assets each contributed to the partnership are as follows:  During the year ended December 31, 2014, the business, Bear-Chew Pet Services, had revenues of $180,000, rent expenses of $12,000, depreciation expense of $2,500, and other operating expenses of $8,400. Other than depreciation expense, all revenues and expenses incurred by the business were for cash. As well, cash of $7,500 was collected on the accounts receivable, with the remainder of the accounts receivable written off. The partnership agreement specifies that Max and Jimmy will share the partnership profit equally. During the year, Max withdrew $40,000 for personal use, and Jimmy withdrew $28,000.

During the year ended December 31, 2014, the business, Bear-Chew Pet Services, had revenues of $180,000, rent expenses of $12,000, depreciation expense of $2,500, and other operating expenses of $8,400. Other than depreciation expense, all revenues and expenses incurred by the business were for cash. As well, cash of $7,500 was collected on the accounts receivable, with the remainder of the accounts receivable written off. The partnership agreement specifies that Max and Jimmy will share the partnership profit equally. During the year, Max withdrew $40,000 for personal use, and Jimmy withdrew $28,000.

Instructions

a. Prepare the journal entry to record the two partners' contributions on January 1, 2014.

b. Prepare the partnership's income statement, statement of partners' equity, and balance sheet at December 31, 2014.

Definitions:

Customer Relationship Management

A strategy for managing an organization’s relationships and interactions with current and potential customers by using data analysis to study large amounts of information.

Capture

The process of obtaining something of value, often referring to attention, data, or market share in business contexts.

Analyze Consumer Data

The process of examining and interpreting data on customers' behaviors and preferences to make informed business decisions.

Geofencing

A location-based technology that creates a virtual boundary around a geographical area, triggering an action when a device enters or leaves that area.

Q3: When admitting a new partner by investment,

Q14: The concept of a "separate legal existence"

Q65: When a change in accounting policy occurs,<br>A)

Q66: Annual depreciation expense needs to be revised

Q102: In the liquidation of a partnership, any

Q106: Two proprietorships CANNOT combine and form a

Q107: The liquidation of a partnership ends the

Q123: The average cost per common share is<br>A)

Q142: The diminishing-balance method is the most common

Q184: Land improvements decline in service potential with