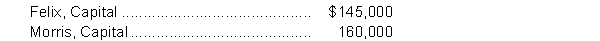

The Felix and Morris Partnership has capital account balances as follows:  The partners share profit and losses in the ratio of 60% to Felix and 40% to Morris.

The partners share profit and losses in the ratio of 60% to Felix and 40% to Morris.

Instructions

Prepare the journal entry on the books of the partnership to record the admission of Singh as a new partner under the following three independent circumstances:

a. Singh pays $80,000 to Felix and $95,000 to Morris for one-half of each of their ownership interests in a personal transaction.

b. Singh invests $150,000 in the partnership for a one-third interest in partnership capital.

c. Singh invests $1,000,000 in the partnership for a one-third interest in partnership capital.

Definitions:

Garden Gnomes

Decorative statues often placed in gardens, depicting mythological creatures known as gnomes.

Demand Curve

A graph showing the relationship between the price of a good and the quantity demanded, typically downward sloping, indicating that demand decreases as price increases.

Plaster

A building material made of lime or gypsum, water, and sand, used for coating walls and ceilings.

Labor

The deployment of human manpower, both in physical form and intellectual capacity, for generating goods and services.

Q39: IFRS will be the standard for all

Q63: Three types of partnerships were described in

Q63: After the warranty liability has been established,

Q83: The entry made by Grimwood Brick Company

Q101: A partnership<br>A) is an association of one

Q112: At the declaration date, the stock dividend

Q116: Which of the following statements concerning taxation

Q131: Income tax expense is based on<br>A) profit

Q134: In the withdrawal of a partner, a

Q162: Which one of the following items is