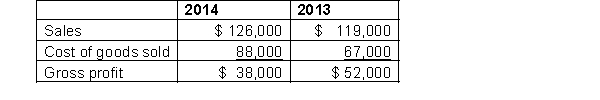

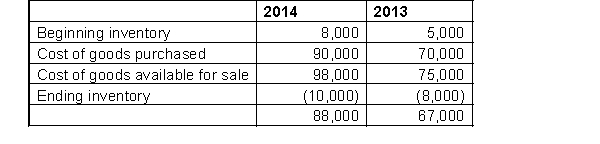

Winston Auto Parts reported the following information in its income statement for 2013 and 2014:  Additional Information:

Additional Information:  While completing Winston's 2015 financial statements, the accountant realized that errors had been made in previous years' inventory calculations. The correct ending inventory at December 31, 2012 was $6,000, the correct ending inventory at December 31, 2013 was $4,000, and the correct ending inventory at December 31, 2014 was $7,000.

While completing Winston's 2015 financial statements, the accountant realized that errors had been made in previous years' inventory calculations. The correct ending inventory at December 31, 2012 was $6,000, the correct ending inventory at December 31, 2013 was $4,000, and the correct ending inventory at December 31, 2014 was $7,000.

Instructions

a. Calculate the correct cost of goods sold and gross profit for 2013 and for 2014.

b. Calculate the inventory turnover for 2013 and 2014:

(i) using the originally reported information; and

(ii) using the corrected information.

c. Calculate the gross profit margin for 2013 and 2014:

(i) using the originally reported information; and

(ii) using the corrected information.

d. Explain how the errors will have caused management performance to be improperly evaluated.

Definitions:

Psychophysiological Model

A theoretical model in psychology that explains behaviors and experiences in terms of the interaction between psychological and physiological processes.

Culture-Bound Syndromes

Mental health or behavioral patterns that are only recognized within specific cultures or societies and may not be universally acknowledged.

Anorexia Nervosa

An eating disorder characterized by an inability to maintain a healthy body weight, an intense fear of gaining weight, and a distorted body image.

Amok

A culturally bound syndrome often characterized by episodes of sudden mass assault against people or objects usually by a single individual following a period of brooding.

Q14: A company is required to prepare adjusting

Q19: The following data are taken from the

Q40: If prices are falling, FIFO will report

Q43: Brown's Convenience is open 7 days a

Q49: After the adjusting entries are journalized and

Q79: Sales using a non bank credit card

Q135: Which of the following accounts has a

Q137: An adjusting entry<br>A) affects two balance sheet

Q190: Which is NOT a method of depreciation?<br>A)

Q213: If an intangible with an indefinite life