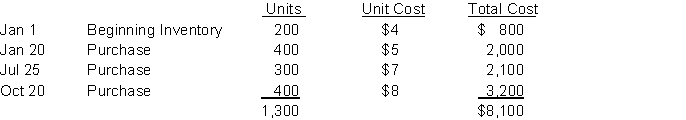

McQuire Company uses the periodic inventory method and had the following inventory information available:  A physical count of inventory on December 31 revealed that there were 600 units on hand.

A physical count of inventory on December 31 revealed that there were 600 units on hand.

Instructions

Answer the following independent questions and show calculations supporting your answers.

a. Assume that the company uses the FIFO cost formula. The value of the ending inventory at December 31 is $__________.

b. Assume that the company uses the average cost formula. The value of the ending inventory on December 31 is $__________.

c. Determine the difference in the amount of income that the company would have reported if it had used FIFO instead of Average. Would income have been greater or less?

Definitions:

Smoot-Hawley Tariff

A U.S. law enacted in 1930, which raised tariffs on over 20,000 imported goods to record levels, leading to a significant decrease in international trade.

Great Depression

A severe worldwide economic depression that took place mostly during the 1930s, starting in the United States following the stock market crash of 1929.

Revenue-Raising

Activities or policies implemented to increase the financial income of an organization or government.

Farm Subsidies

Financial support and assistance given by the government to farmers and agribusinesses to supplement their income, manage the supply of agricultural commodities, and influence the cost and supply of such commodities.

Q5: The calculation of net purchases includes all

Q7: Gross profit does NOT appear<br>A) on a

Q17: The following information is available from the

Q22: If the item of inventory that had

Q51: The current ratio is expressed as<br>A) current

Q67: If errors occur in the recording process,

Q104: Which of the following items is NOT

Q133: Using the FIFO cost formula, the amount

Q138: A 52 week period is called a(n)

Q140: Dorchester Museum purchased a computer for $3,600