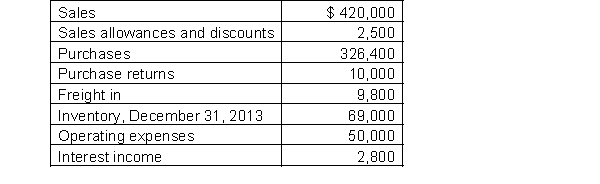

Featherstone Dollar Stores uses the periodic inventory, and completes a physical count of inventory annually and adjusts inventory to actual at each year end. For quarterly (interim) financial statements, they use the gross profit method to estimate inventory. The average of the actual gross profit margin for the most recent two years is used to estimate the quarter-end inventory. The average gross profit margin for the years ending December 31, 2012 and 2013 was 26%.

For Quarter 1, 2014, the following sales and purchases data is available:  Instructions

Instructions

Prepare Featherstone's multi-step income statement for the three months ended March 31, 2014, and calculate the estimated inventory at March 31, 2014.

Definitions:

Programmer-Created Identifiers

Programmer-created identifiers are unique names defined by programmers for variables, functions, and other elements within a codebase.

Standard

An agreed-upon set of guidelines, criteria, or requirements that dictate certain practices or technical specifications.

Primitive

Basic data types provided by a programming language as building blocks for more complex data types.

Executable Statements

Instructions in a program that perform actions, such as assigning values, calling functions, or looping through data.

Q20: The balance sheets of Yin Company include

Q58: Bendo Company receives a discount from its

Q103: Goods out on consignment should be included

Q129: The cash basis of accounting is more

Q134: On December 31, 2014 selected accounts of

Q148: During 2014, Blackmud Research had the following

Q170: On July 1 the Fog Forest Gallery

Q173: Using the average cost formula, the amount

Q186: A company buys merchandise costing $25,000 with

Q228: What is the depreciation expense for 2014?<br>A)