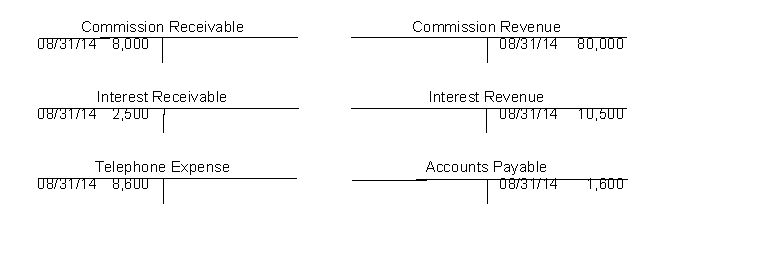

On August 31, 2014 selected accounts of Grand Falls Potatoes, after all year end adjusting entries, show the following data:  Analysis indicates that adjusting entries were made for

Analysis indicates that adjusting entries were made for

1. $8,000 of commission revenue earned but not billed,

2. $2,500 of accrued but interest not received, and

3. $1,600 of telephone expense accrued but not paid.

Instructions

a. Prepare the closing entries at August 31, 2014.

b. Prepare the reversing entries on September 1, 2014.

c. Prepare the entries to record (1) the collection of the accrued commission on September 15, (2) payment of the telephone bill on September 10, and (3) receipt of all the interest due ($4,200) on September 15.

d. What is the interest revenue for the month of September 2014?

Definitions:

Routine Messages

Communications that convey information related to everyday business operations and activities.

Voice Recognition

A technology that identifies and processes human voice input to understand and execute commands or transcribe spoken words into text.

Computer Data

Information processed or stored by a computer, in various forms like text, images, audio, or videos.

Q38: The Sales Discount account is a contra

Q60: A partnership must have at least 2

Q61: Which of the following would NOT affect

Q69: The following ledger accounts are used by

Q85: Archie and Associates is a financial planning

Q88: On October 1, Keiler Motorcycle Shop had

Q114: A company makes a purchase for $250

Q132: A service proprietorship shows five transactions summarized

Q154: The managers of Tong Company receive performance

Q157: Pat's Party Planning provides food service and