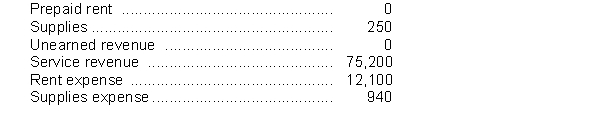

The following amounts are taken from the unadjusted trial balance of Woodstock Company at its year end, April 30 and are their normal balance (debit or credit). Woodstock records all prepaid expenses and revenue in their respective expense or revenue accounts when paid or received. Woodstock records adjusting entries annually when preparing its year end financial statements.  The following transactions are included in the above account balances:

The following transactions are included in the above account balances:

1. On April 1, through a $2,100 cheque, Woodstock's accountant paid both April and May rent and posted the full amount to Rent Expense

2. On April 22 supplies were purchased on account for $740. On April 30 a count of actual supplies on hand shows the remaining supplies to be $81.

3. On January 1 a customer paid $8,000 in advance for a service contract. As of April 30 the work was 40% complete.

Instructions

a. Journalize the transactions described as (1) through (3). Include the date, but no explanation is required.

b. Prepare any adjusting entries required at April 30.

c. Determine the adjusted ending balances of the accounts listed above. Indicate whether the ending balance is a debit or credit.

d. Assuming that profit before adjusting entries were made is $12,850, calculate the adjusted profit.

Definitions:

Additional Income

Extra earnings obtained beyond the regular sources of income or revenue.

Proportional Tax

A tax whose burden is the same proportion of income for all households.

Regressive Tax

A tax whose burden, expressed as a percentage of income, falls as income increases.

Proportional Tax

A tax system where the rate remains constant regardless of the amount on which the tax is imposed.

Q2: A simple journal entry requires only one

Q20: The balance sheets of Yin Company include

Q41: When the original entry for unearned revenue

Q53: A company has only one accounting cycle

Q72: A business will divide the life of

Q72: Ogilvie Homes is a business owned by

Q75: One item is omitted in each of

Q84: The work sheet for the Plateo Rental

Q109: Klondike Music sells musical instruments. The following

Q147: Under International Financial Reporting Standards, current assets