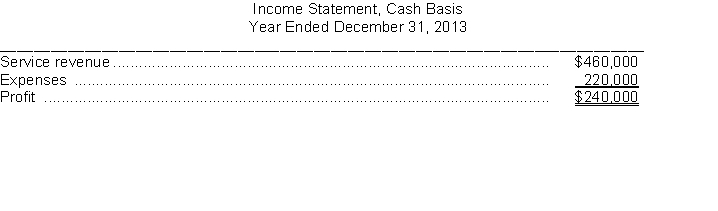

The Larson Company prepared the following income statement using the cash basis of accounting:

THE LARSON COMPANY  Additional data:

Additional data:

1. Service revenue includes $40,000 collected from a customer for whom services were provided in 2012, and who was billed in 2012.

2. There are an additional $15,000 of expenses that were incurred on account, for which payment will not be made until 2014.

3. Depreciation on a company automobile for the year amounted to $7,000. This amount is not included in the expenses above.

4. On December 1, 2013, paid $1,600 for two months' rent (December and January). This amount is included in the expenses above.

Instructions

a. Prepare Larson's income statement on the accrual basis in conformity with generally accepted accounting principles. Show calculations and explain each change.

b. Explain which basis (cash or accrual) provides a better measure of profit.

Definitions:

Vision

The ability to see, resulting from the processes of light being detected by the eyes and interpreted by the brain.

Colour

The property of objects as perceived by the human eye and brain due to the way an object reflects or emits light.

Pupil

The opening in the center of the iris of the eye that regulates the amount of light that enters the eye, adjusting in size based on light conditions.

Dilated

Refers to the expansion or widening of a structure or opening.

Q12: Cash is a temporary account and it

Q13: If total credits in the income statement

Q15: Thrasymachus thought that "might makes right" because

Q84: Posting must be completed before a trial

Q93: Delaurier and Associates is an accounting practice.

Q116: Expense recognition is tied to revenue recognition

Q126: The adjusted trial balance of Singh Company

Q159: Owner's equity is often referred to as<br>A)

Q160: Johnny S is a barber who does

Q177: If an Interest Receivable account is debited