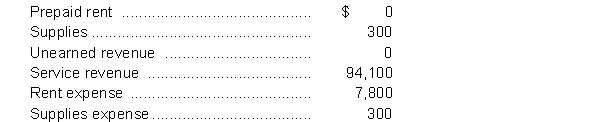

The following amounts are taken from the unadjusted trial balance of Candy Cane Lighting at its year end, November 30, and are their normal balance (Debit or Credit). Candy Cane records all prepaid expenses and revenue in their respective expense or revenue accounts when paid or received. Candy Cane records adjusting entries annually when preparing its year end financial statements.  The following transactions are included in the above account balances:

The following transactions are included in the above account balances:

1. On November 1, through a $1,200 cheque, Candy Cane's bookkeeper paid both November and December rent and posted the full amount to Rent Expense

2. On November 15 supplies were purchased on account for $225. On November 30 a count of actual supplies on hand shows the remaining supplies to be $60.

3. On August 31 a customer paid $4,600 in advance for a service contract. As of November 30 $2,300 of the work was complete.

Instructions

a. Journalize the transactions described as (1) through (3). Include the date, but no explanation is required.

b. Prepare any adjusting entries required at November 30.

c. Determine the adjusted ending balances of the accounts listed above. Indicate whether the ending balance is a Debit or Credit.

d. Assuming that Profit before adjusting entries were made is $4,600, calculate the adjusted Profit.

Definitions:

Triceps

A muscle located at the back of the upper arm, responsible for extending the elbow.

Three Heads

typically refers to a muscle having three points of origin or attachments, such as the triceps brachii.

Single Insertion

When a muscle or tendon attaches to bone at one point or site.

Brachialgia

Pain in the arm, often deriving from nerve irritation or damage.

Q2: Do you think determinism is true? From

Q12: Locke was an empiricist in that he

Q13: The primary purpose of the Cash Flow

Q21: Eliminative materialism is the view that _.<br>A)

Q65: The trial balance of P. Heavy Record

Q72: Jasmine Company received a $350 cheque from

Q117: The normal balance of any account is

Q125: Transactions are entered in the ledger first

Q130: The Boltenhouse Museum paid employee wages on

Q133: Cost of goods available for sale, in