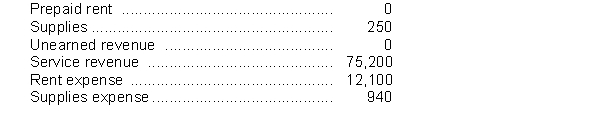

The following amounts are taken from the unadjusted trial balance of Woodstock Company at its year end, April 30 and are their normal balance (debit or credit). Woodstock records all prepaid expenses and revenue in their respective expense or revenue accounts when paid or received. Woodstock records adjusting entries annually when preparing its year end financial statements.  The following transactions are included in the above account balances:

The following transactions are included in the above account balances:

1. On April 1, through a $2,100 cheque, Woodstock's accountant paid both April and May rent and posted the full amount to Rent Expense

2. On April 22 supplies were purchased on account for $740. On April 30 a count of actual supplies on hand shows the remaining supplies to be $81.

3. On January 1 a customer paid $8,000 in advance for a service contract. As of April 30 the work was 40% complete.

Instructions

a. Journalize the transactions described as (1) through (3). Include the date, but no explanation is required.

b. Prepare any adjusting entries required at April 30.

c. Determine the adjusted ending balances of the accounts listed above. Indicate whether the ending balance is a debit or credit.

d. Assuming that profit before adjusting entries were made is $12,850, calculate the adjusted profit.

Definitions:

Cross-Cultural

Relating to or comparing two or more cultures, aiming to understand their differences and similarities to enhance interactions and reduce conflicts.

Social Empathy

The ability to understand and share the feelings or attitudes of others within a social context.

Emotional Intelligence

The ability to recognize, understand, manage, and use one’s own emotions and those of others in positive ways.

Cross-Cultural

Pertaining to or considering the differences and similarities between cultures, often in the context of international relations, business, or communication.

Q21: To close the depreciation expense account<br>A) income

Q27: On July 2, 2014, Midtown Corp. purchased

Q29: Woodpoint Company purchased merchandise from Rockport Company

Q41: A decrease in cost of goods sold

Q47: The adjusting entry on December 31, 2014,

Q57: Short-term debt instruments that are held to

Q72: A business will divide the life of

Q113: When using accrual basis accounting, financial statement

Q126: The Upton Company accumulates the following adjustment

Q147: In the accrual basis of accounting, revenue