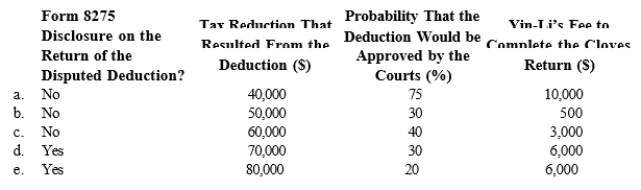

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Unit Sales

The total quantity of product units that a company sells to its customers.

Price Decrease

A reduction in the selling price of goods or services, often used as a strategy to increase demand or sales.

Percentage Change

A mathematical calculation that indicates how much a value has increased or decreased as a percentage from its original amount.

Traceable Fixed Expense

Costs that can be directly linked to a specific segment or unit of a business, and do not change with the level of output.

Q21: ForCo, a foreign corporation, receives interest income

Q21: Lori, a calendar year individual taxpayer, files

Q34: Concerning the Federal tax on generation-skipping transfers:<br>A)

Q42: Which of the following statements does not

Q99: Which of the following is a specific

Q108: Arbor, Inc., an exempt organization, leases land,

Q108: A state sales/use tax is designed to

Q126: Silvio, a cash basis calendar year taxpayer,

Q142: At the time of her death,

Q145: The Stratford Estate incurs a $25,000 casualty