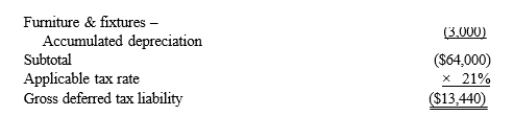

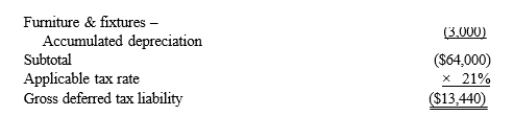

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 21% corporate tax rate and no valuation allowance. Assets Cash Accounts receivable Buildings Accumulated depreciation Furniture & fixtures Accumulated depreciation Total assets Liabilities Accrued litigation expense Note payable Total liabilities Stockholders’ Equity Paid in capital Retained earnings Total liabilities and stockholders’ equity Tax Debit/(Credit) $3005,000300,000(150,000)40,000(21,000)$174,300$−0−(116,000)($116,000)($1,000)(57,300)($174,300) Book Debit/(Credit) $3005,000300,000(80,000)40,000(15,000)$250,300($27,000)(116,000)($143,000)($1,000)(106,300)($250,300) Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are as follows: Accrued litigation expense Subtotal Applicable tax rate Gross deferred tax asset Building - Accumulated depreciation Beginning of Year $20,000$20,000×21%$4,200($61,000)  Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense. Provide the journal entry to record Black's current tax expense.

Definitions:

Strategy

A plan of action designed to achieve a long-term or overall aim.

Risk-Free Rate

The theoretical rate of return of an investment with zero risk, serving as a baseline for assessing the risk and return on other investments.

Stock Option

A derivative financial instrument that gives the holder the right to buy or sell a stock at a specified price before a certain date.

Time to Expiration

Time to expiration refers to the duration until the expiry date of a derivative contract, such as options or futures, impacting its value and the strategies of investors holding or trading it.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.