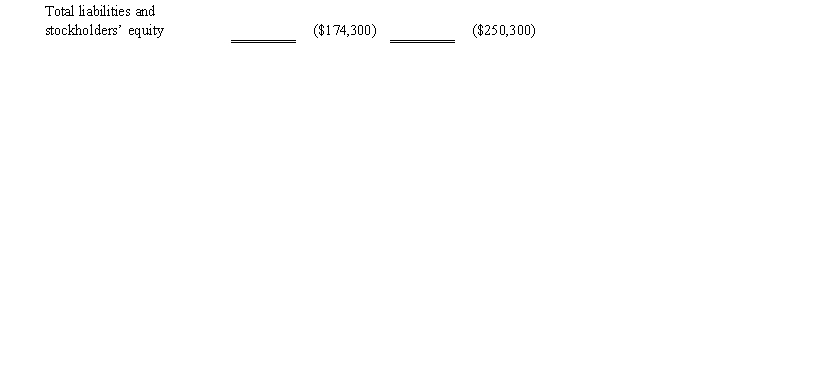

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 21% corporate tax rate and no valuation allowance.

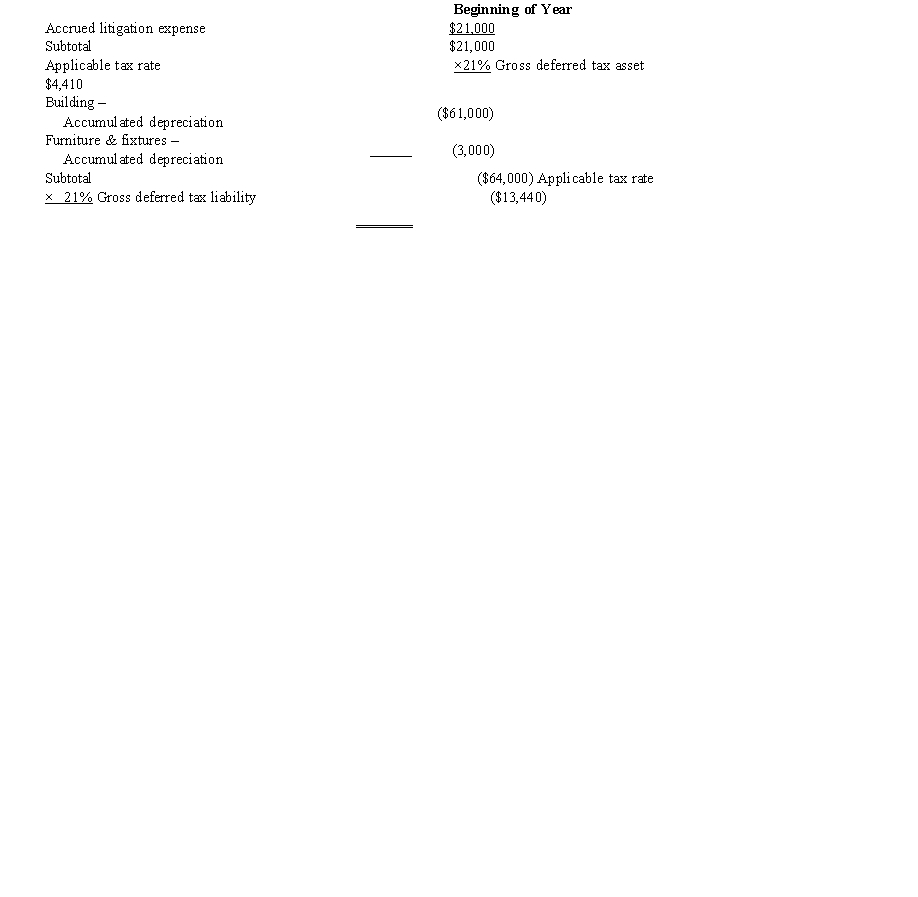

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are as follows:

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are as follows:  Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest and incurred $500 in nondeductible business meals expense. Provide the income tax footnote rate reconciliation for Black, using either

dollars or percentages.

Definitions:

Topic

A subject or theme that is discussed, written about, or studied.

Predetermined Set

A predefined collection of items, options, or criteria established before a process or decision-making.

Response Options

The set of choices provided to respondents in a survey or questionnaire, enabling them to express their opinion, preference, or feedback on a given question.

Questionnaire

A form that features a set of questions designed to gather information from respondents and thereby accomplish the researchers’ objectives; questions can be either unstructured or structured.

Q7: All distributions that are not dividends are

Q13: Wren Corporation (a minority shareholder in Lark

Q24: The gains that shareholders recognize as a

Q27: An accrual basis taxpayer accepts a note

Q38: A corporate net operating loss arising in

Q53: Tomas owns a sole proprietorship, and Lucy

Q57: Robin Corporation, a calendar year taxpayer, has

Q96: The receipt of nonqualified preferred stock in

Q122: On January 30, Juan receives a nontaxable

Q129: In applying the $1 million limit on