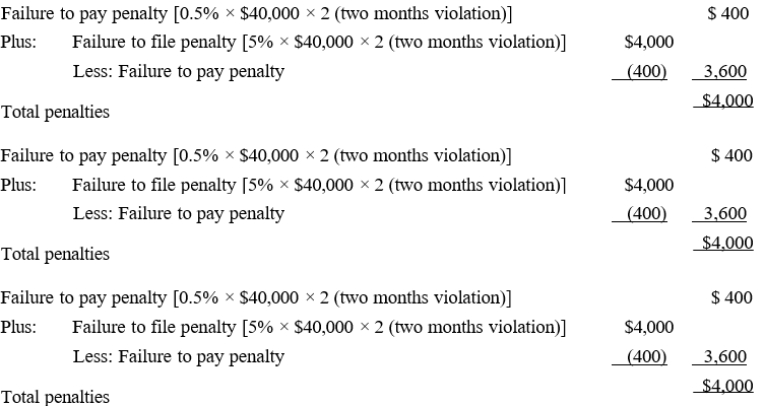

David files his tax return 45 days after the due date. Along with the return, David remits a check for $40,000. which is the balance of the tax owed. Disregarding the interest element, David's total failure to file and to pay penalties are:

Definitions:

Departmentalist

A theory in U.S. constitutional law holding that each branch of the government has the authority to interpret the Constitution in its administration of its own powers.

Supreme Court Interpreter

The term "Supreme Court interpreter" generally refers to the role of the Supreme Court in interpreting the Constitution, laws, and statutes of the United States.

Judicial Scrutiny

The careful examination or review by a court, particularly regarding the constitutionality of laws and government actions.

Senate Judiciary Committee

A standing committee of the U.S. Senate responsible for overseeing judicial administration, including federal court nominations.

Q10: Under Clint's will, all of his property

Q24: Troy knows how to tie his own

Q38: A taxpayer must pay any tax deficiency

Q51: Gain on collectibles (held more than one

Q62: In terms of the properties of languages,

Q88: Federal excise taxes that are no longer

Q108: Melissa is a compulsive coupon clipper. She

Q109: A friend asks you to make a

Q115: With respect to income from services, which

Q148: Sarah furnishes more than 50% of the