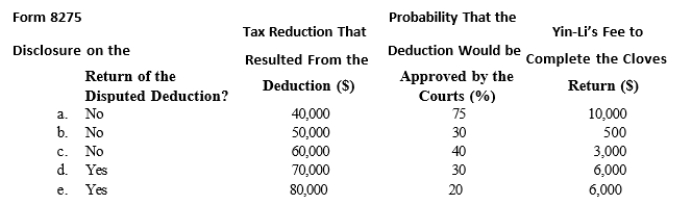

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Inconsistency

The quality of being inconsistent; not staying the same throughout.

Belief

An acceptance that something exists or is true, especially without proof, or the mental acceptance of and conviction in the truth, actuality, or validity of something.

Hindrance

An obstacle or barrier that prevents progress or makes it difficult to achieve a desider goal.

Stressor

Any event, situation, or stimulus that causes stress or strain, challenging an individual's ability to cope.

Q6: In his will, Hernando provides for $50,000

Q10: Tax on failure to distribute adequate amounts

Q30: Roughly 5% of all taxes paid by

Q71: Form 990<br>A)Return of Private Foundation.<br>B)Application for Recognition

Q95: All of the stock of Hot Dog,

Q100: The accuracy-related penalties typically relate to_ on

Q113: The Gomez Trust is required to distribute

Q125: What are the excise taxes imposed on

Q132: A unitary business applies a combined apportionment

Q179: General Corporation is taxable in a number