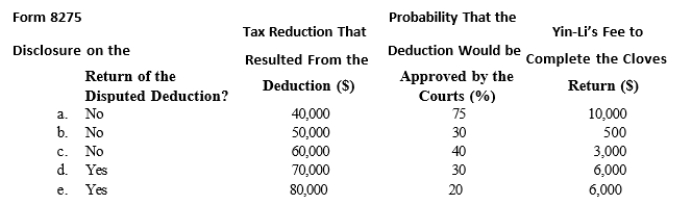

Yin-Li is the preparer of the Form 1120 for Cloves Corporation. On the return, Cloves claimed a deduction that the IRS later disallowed on audit. Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Ambulatory Care

Medical services or treatments that are provided on an outpatient basis, without the need for hospital admission.

Independent Nurse Practitioner

A nursing professional who practices autonomously in diagnosing and treating patients, often in specialized areas of healthcare.

Disease Prevention

The implementation of strategies and practices aimed at reducing the risk and incidence of diseases within a population.

Health Histories

Detailed records of an individual's past medical conditions, treatments, surgeries, and other health-related events.

Q12: Each of the following can pass profits

Q12: The tax consequences to a donor of

Q41: Mark dies on March 6. Which, if

Q65: Under her father's will, Faith is to

Q70: The IRS can require that the taxpayer

Q100: Joint tenancy<br>A)In the current year, Debby, a

Q107: Brad and Heather are husband and wife

Q135: The IRS can waive the penalty for

Q157: Your client Ming is a complex trust

Q175: Hendricks Corporation sells widgets in two states.