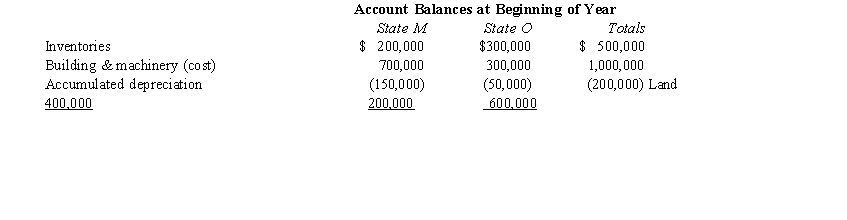

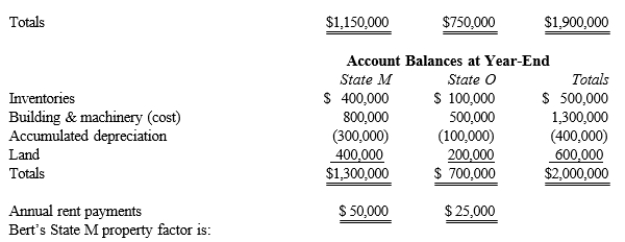

Bert Corporation, a calendar year taxpayer, owns property in States M and O. Both states require that the average value of assets be included in the property factor. State M requires that the property be valued at its historical cost, and State O requires that the property be included in the property factor at its net depreciated book value.

Definitions:

ATP

or Adenosine triphosphate is the primary energy carrier in all living organisms, providing energy for most biochemical cellular processes.

Weak Acid

An acid that partially dissociates into its ions in solution, resulting in a less complete release of hydrogen ions.

Reaction Rate

The speed at which a chemical reaction occurs, influenced by factors such as temperature, concentration, and presence of catalysts.

Reactant Concentration

The amount of a substance present in a unit volume of a reaction mixture, influencing the rate at which a chemical reaction proceeds.

Q33: List some techniques that can be used

Q37: A new S corporation shareholder can revoke

Q51: Valuation of a life insurance policy that

Q58: Can postpone the payment of any estate

Q59: A deferred tax liability represents a potential

Q89: Future interest<br>A)In the current year, Debby, a

Q104: Theater, Inc., an exempt organization, owns a

Q118: Georgia owns an insurance policy on the

Q145: Mercy Corporation, headquartered in State F, sells

Q167: Juarez a calendar year taxpayer) donates a