Guilford Corporation is subject to franchise tax in State Z. The tax is imposed at a rate of 2.5% of the taxpayer's net worth that is apportioned to the state by use of a two-factor sales and property equally weighted) formula. The property factor includes real and tangible personal property valued at net book value at the end of the taxable year. Of Guilford's sales, 60% are attributable to State Z, and $200,000 of the net book value of it's tangible personal property is located in State Z.

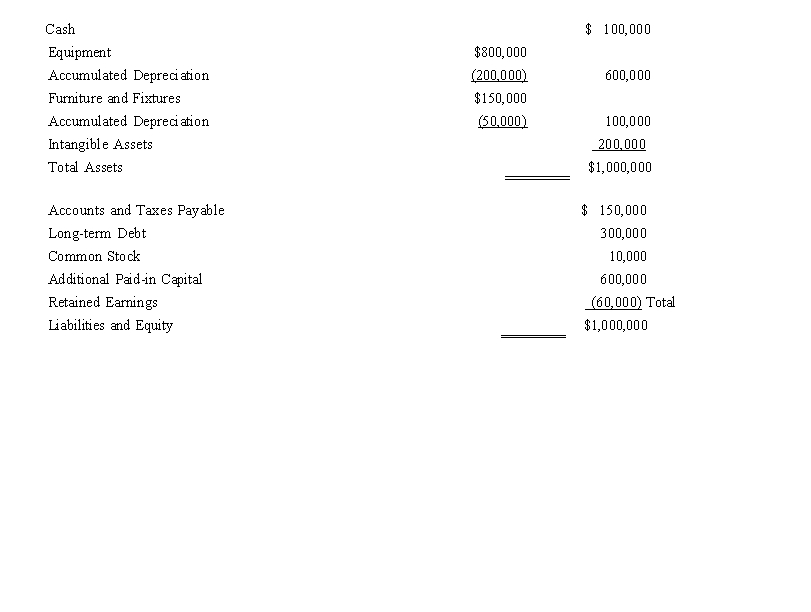

Determine the State Z franchise tax payable by Guilford this year given the following end-of-the year balance sheet:

Definitions:

Dollar-Value LIFO

An inventory valuation method under Last-In, First-Out principle, adjusting for changes in price level or inflation, allowing for a more accurate financial analysis over time.

Inventory Items

Goods or products that a company holds for the ultimate purpose of sale, part of the current assets on a company's balance sheet.

Periodic LIFO

An inventory valuation method that determines the cost of goods sold and ending inventory using the Last In, First Out principle, applied at the end of the accounting period.

FIFO

An inventory valuation method that assumes the first items placed in inventory are the first sold, standing for "First In, First Out."

Q2: An eligible § 501c)3) organization has made

Q2: The tax_ workpapers prepared as part of

Q25: Decedent owned stock that had depreciated in

Q27: Several states allow the S corporation to

Q55: Catfish, Inc., a closely held corporation

Q56: The Federal gift tax does not include

Q69: Tax-exempt income at the S corporation level

Q81: Sole proprietorship<br>A)Ability of all owners to have

Q94: Passing installment notes by death will not

Q137: The_ tax levied by a state usually