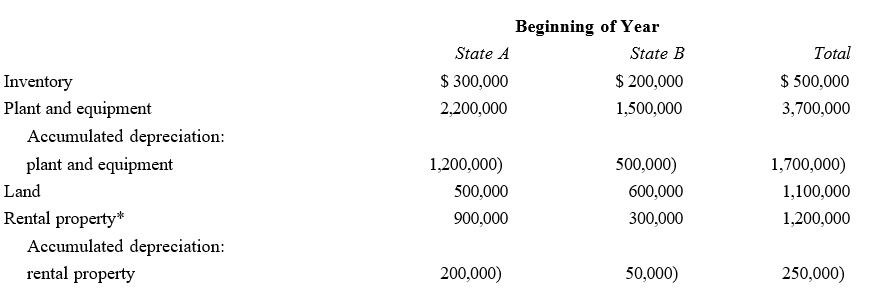

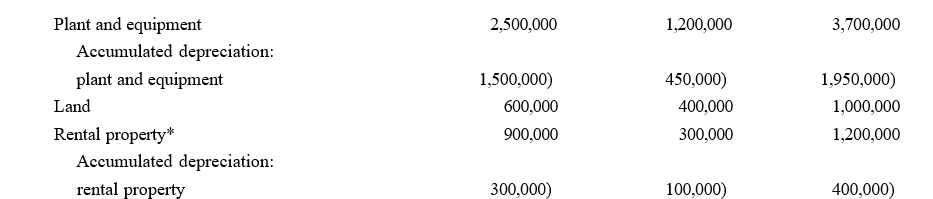

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of Kim's property holdings follows:

*Unrelated to Kim's regular business and operations.

Determine Kim's property factors for the two states. State A's statutes provide that the average historical cost of business property is to be included in the property factor. State B's statutes provide that the property factor is based on the average depreciated basis of in-state business property.

Definitions:

Revenue Recognition

The accounting principle that deals with the conditions under which revenue is recognized and recorded on the financial statements.

Installment Method

An accounting method used to recognize revenue and expenses on long-term contracts and other sales where payment is received in installments.

Qualitative Characteristic

Features or attributes that describe the non-numeric aspects of goods, services, processes or information, often related to quality.

Reliability

The quality or state of being dependable or consistent in performance or outcome.

Q7: An individual's amended tax return that computes

Q35: If an exempt organization conducts a trade

Q68: Using his own funds, Horace establishes a

Q69: In which of the following independent situations

Q84: One of the requirements for an exempt

Q85: If the beginning balance in OAA

Q86: An intermediate sanction imposed by the IRS

Q136: Preparer penalty for taking an unreasonable tax

Q137: In the context of civil tax fraud

Q141: Owning a tablet computer that is used