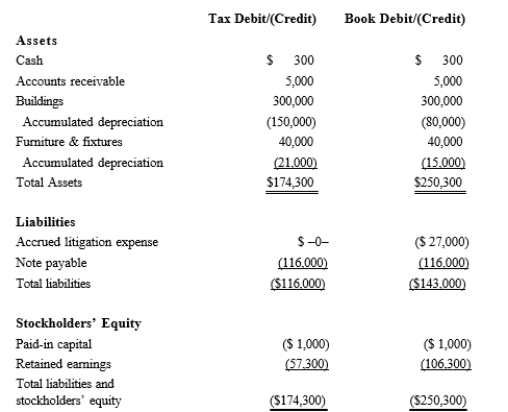

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Assume a 21% corporate tax rate and no valuation allowance.  Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are as follows:

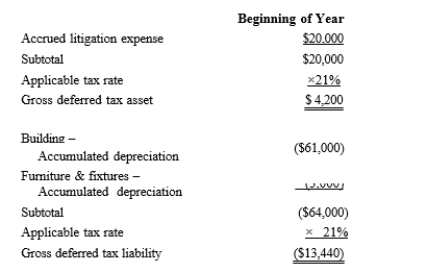

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are as follows:  Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000. Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense. Calculate Black's current tax expense.

Definitions:

Androgen

A group of hormones that play a role in male traits and reproductive activity; examples include testosterone and androsterone.

Pituitary Gland

A small endocrine gland located at the base of the brain that produces various hormones influencing growth, metabolism, and reproduction.

Master Gland

A term commonly used for the pituitary gland, responsible for regulating crucial body functions and controlling other endocrine glands.

Estrogen

A group of hormones responsible for the development and regulation of the female reproductive system and secondary sex characteristics.

Q42: Black, Inc., is a domestic corporation

Q52: An S shareholder's basis is increased by

Q66: P.L. 86-272_ does/does not) create income-tax nexus

Q78: Discuss how a multistate business divides its

Q94: The RST Partnership makes a proportionate distribution

Q102: Specific factors that are used in selecting

Q136: Chipper Corporation realized $1,000,000 taxable income

Q140: A garment purchased by a self-employed actress.<br>A)Taxable<br>B)Not

Q147: Willful and reckless conduct.<br>A)Taxpayer penalty<br>B)Tax preparer penalty<br>C)Appraiser's

Q158: Midway through the current tax year, Georgie