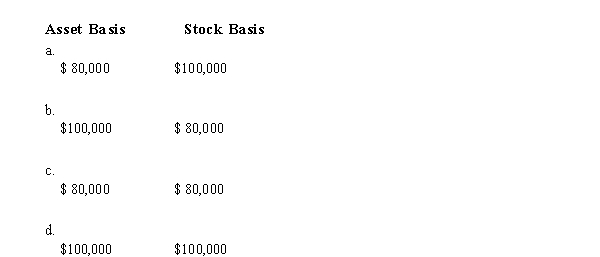

Chen contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a C corporation and the transaction qualifies under § 351, the corporation's basis for the property and the shareholder's basis for the stock are:

Definitions:

Strict Interpretation

Adhering closely to a specific set of rules or guidelines without allowance for flexibility in their application.

Freud's Theory

A comprehensive theory of human psychology developed by Sigmund Freud, emphasizing unconscious processes and the importance of childhood experiences.

Defense Mechanism

Psychological strategies brought into play by individuals to cope with reality and to maintain self-image.

Alfred Adler

Alfred Adler was an Austrian medical doctor and psychotherapist who founded the school of individual psychology and emphasized the importance of feelings of inferiority and the creative self.

Q12: Compute the undervaluation penalty for each

Q13: Arbor, Inc., an exempt organization, leases land,

Q20: Greene Partnership had average annual gross receipts

Q41: You are preparing to make a presentation

Q49: The Form 990-N:<br>A) Is filed by new

Q97: A newly formed S corporation does not

Q100: In a proportionate liquidating distribution, RST Partnership

Q110: Teal, Inc., is a private foundation that

Q124: Earthmoving equipment used by the purchaser in

Q134: General partner<br>A)Organizational choice of many large accounting