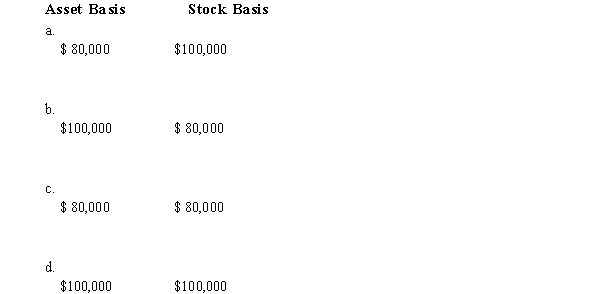

Ruchi contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a partnership and the transaction qualifies under § 721, the partnership's basis for the property and the partner's basis for the partnership interest are:

Definitions:

Law of Continuity

A principle in Gestalt psychology stating that elements that are arranged on a line or curve are perceived to be more related than elements not on the line or curve.

Fovea

A tiny pit located in the macula of the retina, responsible for sharp central vision necessary for activities like reading.

Lens

A curved piece of glass or other transparent materials used in devices like glasses, cameras, and microscopes to focus light rays.

Extrasensory Perception

The claimed ability to obtain information without the use of known sensory processes or physical interaction.

Q8: Gene Grams is a 45% owner

Q34: Discuss two ways that an S election

Q49: The Form 990-N:<br>A) Is filed by new

Q51: Jogg, Inc., earns book net income before

Q60: A unitary group of entities files a

Q63: An S corporation's LIFO recapture amount equals

Q92: To whom do the AICPA's Statements on

Q111: For purposes of the unrelated business income

Q120: Carried interest<br>A)Organizational choice of many large accounting

Q136: In a proportionate liquidating distribution, Sam receives