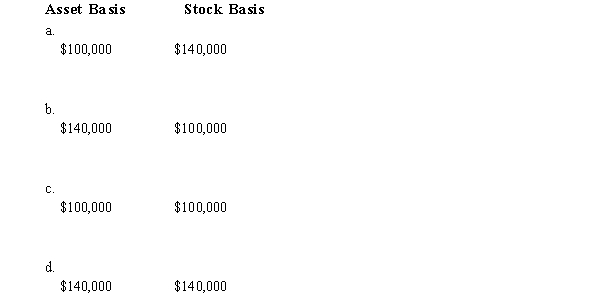

Martin contributes property with an adjusted basis of $100,000 and a fair market value of $140,000 to a newly formed business entity. If the entity is an S corporation and the transaction qualifies under § 351, the S corporation's basis for the property and the shareholder's basis for the stock are:

Definitions:

Executive Success

A measure of the achievement and progress towards goals that an individual in an executive position realizes, often reflecting leadership effectiveness and company performance.

Influence

The power to impact the personality, growth, or actions of an individual or entity, or the impact resulting from this.

Control

The power to influence or direct people's behavior or the course of events.

Referent Power

The capacity to influence other people because of their desire to identify personally with you.

Q6: The amount of a partnership's income and

Q10: Anders, a local business, wants your help

Q64: At the beginning of the year, Schrader,

Q73: For which type of entity is an

Q88: Which of the following allocations is most

Q97: Almost all of the states assess some

Q124: Are organizations that qualify for exempt organization

Q126: What are the common characteristics of organizations

Q145: Mercy Corporation, headquartered in State F, sells

Q173: A taxpayer automatically has nexus with a