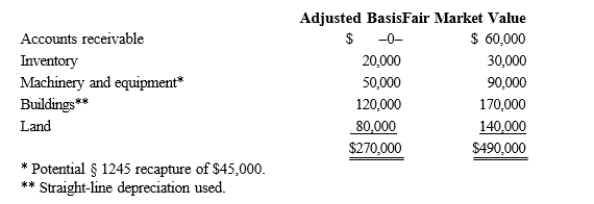

Albert's sole proprietorship owns the following assets.  Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Foreign-Currency Exchange

The system or process of converting one national currency into another and determining the exchange rates.

Government Budget Deficit

An economic condition occurring when government expenditures exceed its revenue in a fiscal period.

Interest Rate

The percentage charged or earned on a principal sum of money or an investment over a specified period of time.

Net Capital Outflow

The difference between the domestic purchases of foreign assets and the foreign purchases of domestic assets.

Q9: Which of the following items, if any,

Q12: Compute the undervaluation penalty for each

Q39: Capital intensive partnership<br>A)Includes the partner's share of

Q46: The sale of groceries to an individual

Q47: One of the disadvantages of the partnership

Q60: A unitary group of entities files a

Q90: At the beginning of the tax year,

Q102: Regular tax rate<br>A)Usually subject to single taxation

Q111: Nonseparately computed loss_ increases, reduces) a S

Q182: In most states, a limited liability company