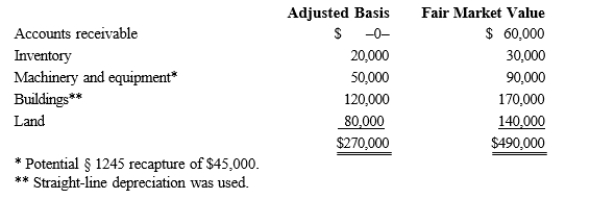

Kristine owns all of the stock of a C corporation which owns the following assets.  Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Social Media Investment

The act of allocating resources, usually financial, into social media platforms to achieve marketing and business objectives.

Ultimate Criteria

The fundamental standards or benchmarks that are used to evaluate the success, effectiveness, or value of a project or initiative.

Conversion Rate

The percentage of users who take a desired action, useful in evaluating the success of a website, advertisement, or marketing strategy.

Engagement

The level of interaction and involvement of a customer or audience with a brand's content, often measured through likes, shares, and comments.

Q2: On January 1 of the current year,

Q18: Nicky's basis in her partnership interest was

Q23: Ordering rules<br>A)Cash basis accounts receivable, for example.<br>B)Fair

Q23: By default, an exempt entity is a:<br>A)

Q26: Purple, Inc., a domestic corporation, owns 80%

Q52: An S shareholder's basis is increased by

Q57: Advise your client how income, expenses, gain,

Q72: Under the UDITPA's_ concept, sales are assumed

Q73: For which type of entity is an

Q147: Trayne Corporation's sales office and manufacturing plant