Luis owns all the stock of Silver, Inc., a C corporation for which his adjusted basis is $225,000. Luis founded Silver

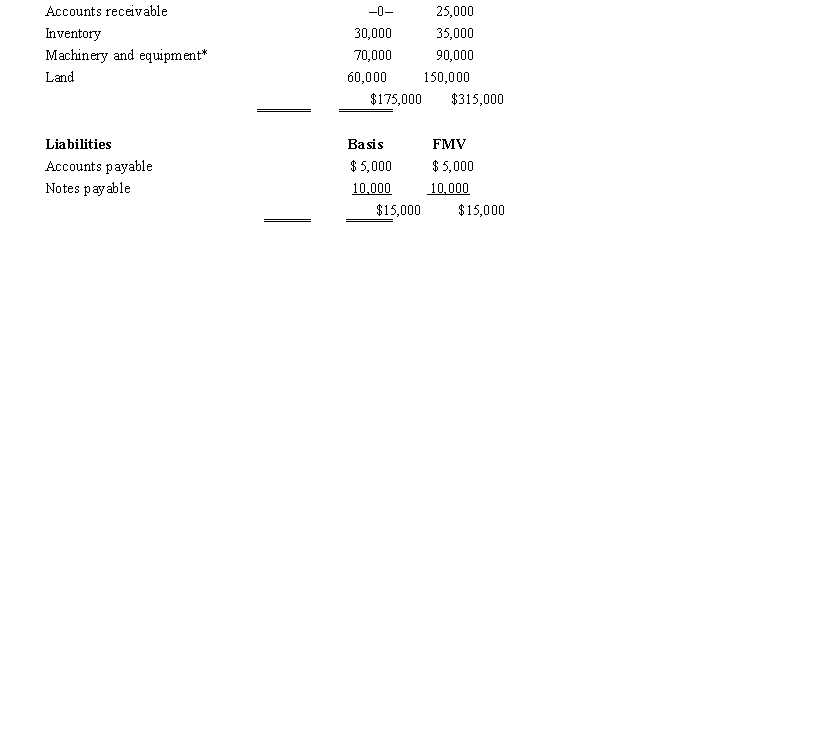

12 years ago. The assets and liabilities of Silver are recorded as follows.  *Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Luis has agreed to sell the business to Marilyn and they have agreed on a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket.

a. Advise Luis on whether the form of the sales transaction should be a stock sale or an asset sale.

b. Advise Marilyn on whether the form of the purchase transaction should be a stock purchases or an asset purchase.

Definitions:

Balance Sheet

A financial report indicating the assets, liabilities, and shareholders' equity of a company at a certain moment, which serves as a foundation for calculating returns and assessing its financial health.

Present Value

The current worth of a future sum of money or stream of cash flows, given a specified rate of return.

Annuity

A financial product that pays out a fixed stream of payments to an individual, typically used as part of a retirement strategy.

Consecutive Payments

Regular payments made in a sequence, without interruption, over a specified period.

Q15: In computing the property factor, property owned

Q17: Midnight Basketball, Inc., an exempt entity that

Q22: Typically exempt from the sales/use tax base

Q40: This year, Jiang, the sole shareholder of

Q88: Net capital gain<br>A)For the corporate taxpayer, taxed

Q102: Distribution of $60,000 cash for a partner's

Q114: Tax on excess business holdings<br>A)10% initial tax

Q118: The exclusion of gain on disposition of

Q128: Computing services purchased by a business.<br>A)Taxable<br>B)Not taxable

Q138: Sharon contributed property to the newly formed