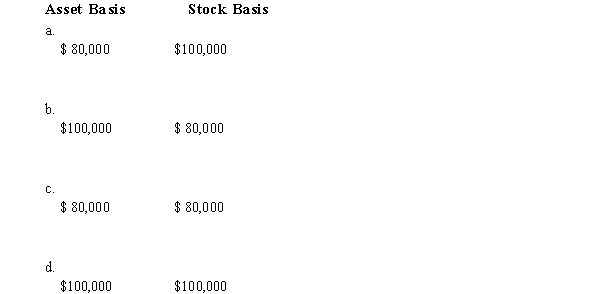

Ruchi contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a partnership and the transaction qualifies under § 721, the partnership's basis for the property and the partner's basis for the partnership interest are:

Definitions:

Perceptual Selection

The process by which individuals filter and select information from their environment based on their preferences, beliefs, and past experiences.

Hand Gestures

Movements of the hands and arms used to convey messages or express emotions nonverbally.

Moutza

A traditional gesture of insult in Greek culture, involving the extension of all five fingers and presenting the palm towards someone.

Intensity

The strength, concentration, or degree of force or energy exhibited in an activity, situation, or expression.

Q18: Drieser Corporation's manufacturing facility, distribution center,

Q37: Book-tax differences can be explained in part

Q46: James received a distribution of $110,000 cash

Q49: Bidden, Inc., a calendar year S

Q56: Sales/use tax in most states applies to

Q62: Fred and Wilma formed the equally owned

Q74: Aggregate concept<br>A)Organizational choice of many large accounting

Q101: C corporations are not subject to AMT

Q115: A per-day, per-share allocation of flow-through S

Q133: Preparer penalty for reckless conduct.<br>A)Ignorance of the