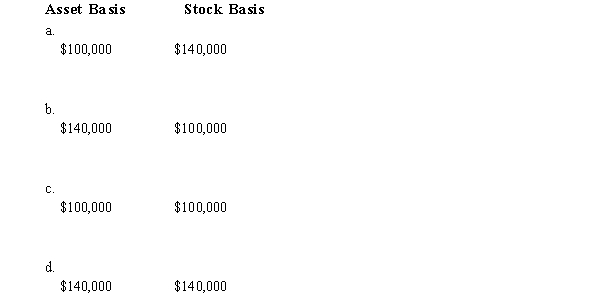

Martin contributes property with an adjusted basis of $100,000 and a fair market value of $140,000 to a newly formed business entity. If the entity is an S corporation and the transaction qualifies under § 351, the S corporation's basis for the property and the shareholder's basis for the stock are:

Definitions:

Binge-Eating Disorder

A disorder characterized by recurrent episodes of eating large quantities of food in a short period of time, often accompanied by feelings of loss of control and guilt.

Diagnostic Criteria

The specific conditions and signs that must be present for a healthcare professional to diagnose a particular disorder or disease.

Obesity

A medical condition characterized by excess body fat that increases the risk of health problems.

Risks

The potential for experiencing harm, loss, or adverse effects in a given situation or for a specific condition.

Q13: Arbor, Inc., an exempt organization, leases land,

Q21: Both Albert and Elva own 50% of

Q23: The Net Investment Income Tax NIIT) is

Q34: Corporate sponsorship payments<br>A)Distribution of such items is

Q70: § 501c)4) civic league<br>A)League of Women Voters.<br>B)Teachers'

Q73: Which transaction affects the Other Adjustments Account

Q73: Parent and Minor form a non-unitary group

Q80: Chung's AGI last year was $180,000. Her

Q134: General partner<br>A)Organizational choice of many large accounting

Q143: Typically, the state's payroll factor _does/does not)