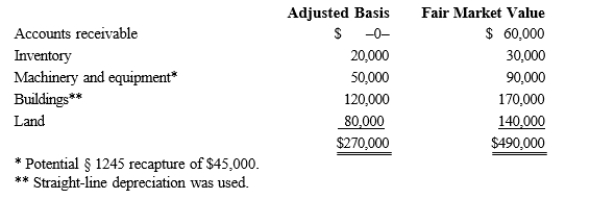

Kristine owns all of the stock of a C corporation which owns the following assets.  Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Vertigo

A condition characterized by a sensation of spinning or dizziness, often caused by problems within the inner ear or the vestibular nerve.

Tinnitus

The perception of noise or ringing in the ears, a common problem that can result from various underlying causes and can affect one's quality of life.

Nausea

A feeling of discomfort in the stomach often characterized by an urge to vomit.

Vomiting

The forceful expulsion of the contents of the stomach through the mouth.

Q5: C corporation<br>A)Contribution of appreciated property to the

Q37: The tax preparer penalty for taking an

Q44: Explain the OAA concept.

Q47: Both Tracy and Cabel own one-half of

Q50: §704b) book<br>A)Organizational choice of many large accounting

Q59: A deferred tax liability represents a potential

Q67: The model law relating to the assignment

Q119: Which of the following entity owners cannot

Q123: A § 501c)3) exempt organization excluding churches

Q126: Highly appreciated land held by the partnership