Luis owns all the stock of Silver, Inc., a C corporation for which his adjusted basis is $225,000. Luis founded Silver

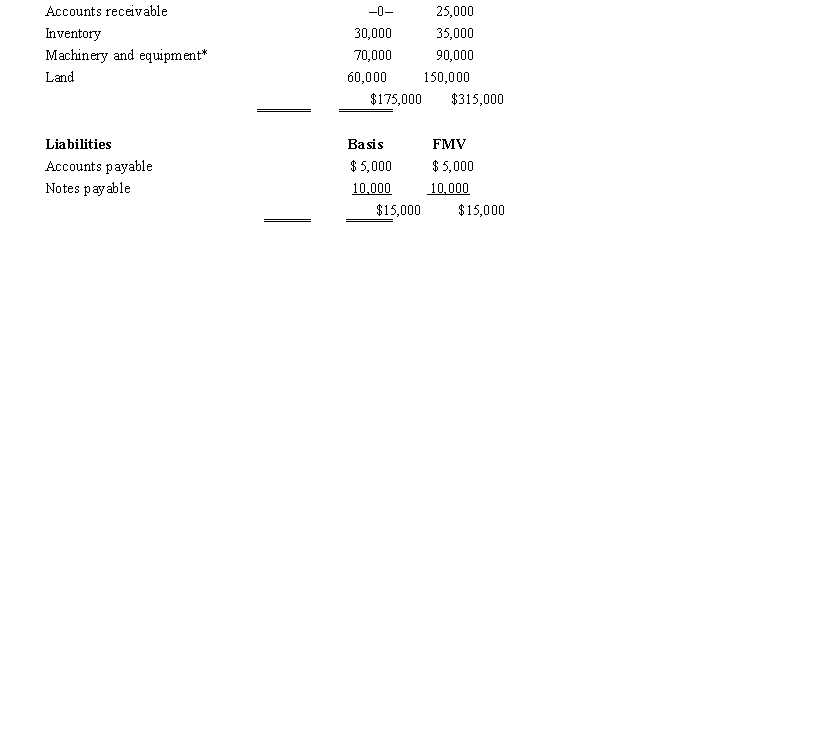

12 years ago. The assets and liabilities of Silver are recorded as follows.  *Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Luis has agreed to sell the business to Marilyn and they have agreed on a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket.

a. Advise Luis on whether the form of the sales transaction should be a stock sale or an asset sale.

b. Advise Marilyn on whether the form of the purchase transaction should be a stock purchases or an asset purchase.

Definitions:

Lorenzo De' Medici

An Italian statesman and de facto ruler of the Florentine Republic during the Italian Renaissance, known for his patronage of the arts and scholarship.

Savonarola

Girolamo Savonarola was a Dominican friar and preacher in Renaissance Florence who is known for his prophecies of civic glory, the destruction of secular art and culture, and his call for Christian renewal.

Camera Degli Sposi

A room in the Ducal Palace of Mantua, Italy, celebrated for its frescoes by Andrea Mantegna that include trompe l'oeil effects and courtly scenes.

Mantegna

Italian Renaissance artist Andrea Mantegna, celebrated for his mastery in perspective and detailed frescoes that vividly depict historical and religious scenes.

Q17: Only U.S. corporations are included in a

Q18: At the beginning of the year, Heather's

Q21: Which of the following is not a

Q23: The Net Investment Income Tax NIIT) is

Q87: An S corporation is not subject to

Q89: Corey is going to purchase the assets

Q91: Belinda owns a 30% profit and loss

Q94: The corporate-level tax on recognized built-in gains

Q126: What are the common characteristics of organizations

Q131: WillCo completes the construction of production facilities