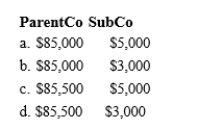

ParentCo and SubCo report the following items of income and deduction for the current year. ParentCo's SubCo's Taxable Item Taxable Income Income Income loss) from operations $100,000 $10,000)

§ 1231 loss 5,000)

Capital gain 15,000

Charitable contribution 12,000

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Definitions:

Field Description

A brief explanation or detailing of what data should be entered in a particular field in a database or form.

Field Size

The maximum number of characters or the specific type of data that can be stored in a database field.

Data Type

A classification identifying one of various types of data, such as integer, floating point, or string, that determines the possible values for that type.

Subdatasheet

A feature in Microsoft Access that allows users to view related data from a different table as a nested datasheet within a main datasheet.

Q11: When a "Type F" reorganization includes a

Q30: Binding nature of election over multiple tax

Q42: Describe the general computational method used by

Q45: The consolidated net operating loss of the

Q55: A Federal consolidated filing group aggregates its

Q67: Proceeds of life insurance received upon the

Q82: Section 332 can apply to a parent-subsidiary

Q87: Explain the stock attribution rules that apply

Q104: Humming Inc. is interested in acquiring BirdCo,

Q117: At the beginning of the current year,