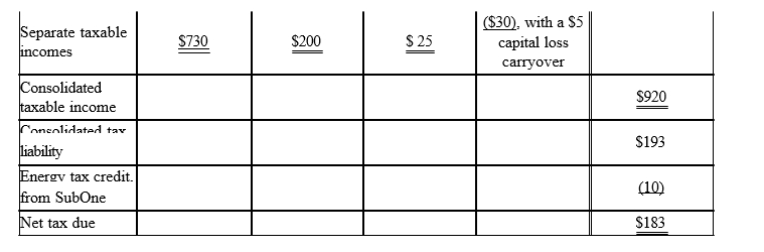

The Parent consolidated group reports the following results for the tax year. Determine each member's share of the consolidated tax liability, assuming that all members have consented to use the relative taxable income tax-sharing method. Dollar amounts are listed in millions, and a 21% income tax rate applies to all of the entities.

Definitions:

Minority Families

Families that belong to a racial, ethnic, or cultural minority group within a larger society, often facing unique challenges and dynamics.

Unconscious Racism

Implicit biases and prejudices towards other races that individuals may not be aware of harboring.

Anti-Black Attitudes

Prejudiced beliefs, feelings, or attitudes toward black people that are characterized by discrimination or hostility.

Anti-Hispanic Attitudes

Negative biases or prejudices specifically directed towards Hispanic individuals or communities.

Q1: How are the members of a Federal

Q46: WorldCo, a foreign corporation not engaged in

Q48: An example of an intercompany transaction is

Q50: In a § 351 transfer, a shareholder

Q70: Which of the following statements regarding income

Q76: Kirby and Helen form Red Corporation. Kirby

Q79: When is a redemption to pay death

Q88: If, on joining an affiliated group, SubCo

Q102: Distribution of $60,000 cash for a partner's

Q124: At the beginning of the current year,