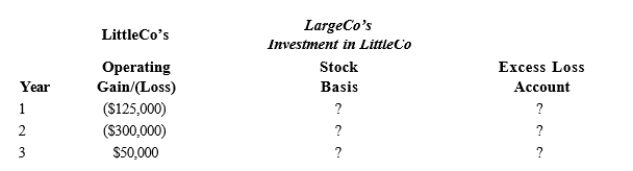

LargeCo files on a consolidated basis with LittleCo. The subsidiary was acquired for $400,000 on January 1, year 1, and it paid a $75,000 dividend to LargeCo at the end of both year 2 and year 3.

a. Given the following information about the subsidiary's operating results, derive the requested amounts as of

December 31 of each year. The group files using a calendar year.

b. LargeCo sold LittleCo to an unrelated competitor for $600,000 on December 31, year 3. How will LargeCo account for this sale?

Definitions:

Criminal Profiling

The process of predicting a criminal's characteristics based on the nature of the crime or other available evidence.

Applied Personality Testing

The use of psychological tests and assessments to evaluate individual differences in personality traits and characteristics, often for employment or therapeutic purposes.

Accurate Profiles

Detailed and precise descriptions or analyses of individuals' characteristics, often used in psychological assessments.

Criminal Profiling

The practice of predicting a criminal's characteristics based on crime scene evidence and other factors.

Q22: When a taxpayer incorporates her business, she

Q27: Which of the following statements regarding foreign

Q32: Distribution of $100,000 cash to a managing

Q66: All the following should apply to a

Q70: Calendar year Parent Corporation acquired all

Q74: Aggregate concept<br>A)Organizational choice of many large accounting

Q79: Any asset other than stock or securities

Q106: Daisy Corporation is the sole shareholder of

Q124: A tax haven often is:<br>A) A country

Q140: If a partnership earns tax-exempt income, the