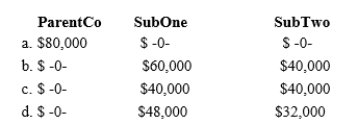

ParentCo, SubOne, and SubTwo have filed consolidated returns since year 2. All of the entities were incorporated in Taxable income computations for the members include the following. None of the group members incurred any capita transactions during these years, nor did they make any charitable contributions. How should the Year 3 consolidated net operating loss be apportioned among the group members?

Definitions:

Personality Type

Distinct patterns of thought, feeling, and behavior that characterize an individual’s adjustments to the world; often categorized into specific types or categories.

Detached

Emotional or physical disengagement or separation from others, often as a defense mechanism or coping strategy.

Need for Privacy

The individual desire or requirement for personal space and confidentiality.

Neurotic Trends

Three categories of behaviors and attitudes toward oneself and others that express a person’s needs; Horney’s revision of the concept of neurotic needs.

Q14: Mars Corporation merges into Jupiter Corporation by

Q21: A taxpayer may never recognize a loss

Q50: Jeremiah received a proportionate nonliquidating distribution of

Q67: Proceeds of life insurance received upon the

Q67: Obtaining a favorable letter ruling from the

Q77: Paul sells one parcel of land basis

Q83: Indigo corporation has a basis of $1

Q99: Robin Corporation distributes furniture basis of $40,000;

Q108: Falcon Corporation ended its first year of

Q132: Limited liability partnership<br>A)Organizational choice of many large