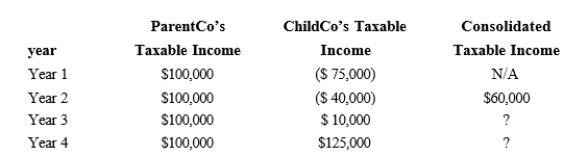

ParentCo purchased all of the stock of ChildCo on January 2, year 2, and the two companies filed consolidated returns for year 2 and thereafter. Both entities were incorporated in year 1. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions. No § 382 limit applies.  To what extent can ChildCo's year 1 losses be used by the group in year 4?

To what extent can ChildCo's year 1 losses be used by the group in year 4?

Definitions:

Population

The entire group of individuals or instances about whom the data is collected and which the statistical analysis is based upon.

Confidence Interval

A span of values, coming from sample observations, expected to include the value of a not-yet-identified population characteristic.

Degrees Of Freedom

The number of independent data points in a statistical calculation that are free to vary.

T-Distribution

A probability distribution that arises when estimating the mean of a normally distributed population in situations where the sample size is small and the standard deviation is unknown.

Q20: Black Corporation has been engaged in manufacturing

Q23: Crested Serpent Eagle CSE) Corporation is owned

Q60: All members of an affiliated group have

Q69: The tax treatment of the parties involved

Q69: A parent-subsidiary controlled group exists where there

Q84: Julie is an active owner of a

Q103: Distribution of $10,000 cash to a general

Q113: Racket Corporation and Laocoon Corporation create Raccoon

Q148: Limited partner<br>A)Includes the partner's share of partnership

Q156: To meet the substantial economic effect tests,