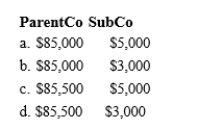

ParentCo and SubCo report the following items of income and deduction for the current year. ParentCo's SubCo's Taxable Item Taxable Income Income Income loss) from operations $100,000 $10,000)

§ 1231 loss 5,000)

Capital gain 15,000

Charitable contribution 12,000

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis. Then compute the total of those amounts if appropriate.

Definitions:

Stock Price

The current price at which a share of a company is bought or sold on the stock market.

Cost Of Goods Sold

The total cost of materials and labor directly associated with the production of goods sold by a business.

Direct Costs

Direct costs are expenses directly associated with the production of goods or services, such as materials and labor.

Global Capital Market

The worldwide financial markets in which money flows for the purpose of investment and financing across different countries.

Q5: Gold Corporation has accumulated E & P

Q24: Fern, Inc., Ivy, Inc., and Jeremy formed

Q38: Josh owns a 25% capital and

Q49: Orson was a 40% partner in the

Q51: An exchange of common stock for preferred

Q76: Additional first-year bonus) depreciation deduction claimed in

Q79: When negative adjustments are made to the

Q87: Gains on the sale of U.S. real

Q91: During the current year, Ecru Corporation is

Q141: Harry's basis in his partnership interest was