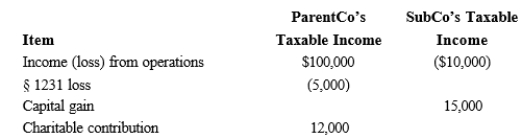

ParentCo and SubCo report the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

Definitions:

Total Expense Line

A financial metric that represents the sum of all expenses encountered by a business, usually presented in the income statement.

Total Revenue Line

A financial metric representing the total amount of money generated from sales before any expenses are subtracted.

Sales Mix

The proportion of different products or services that a company sells, representing the combination of sales that impacts overall profitability.

Total Profits

The sum of net income or net earnings of a company after all expenses, including taxes and costs, have been deducted from total revenue.

Q3: Sparrow Corporation purchased 90% of the stock

Q26: Pallid Swift, Inc. is an S corporation

Q59: Consolidated estimated tax payments must begin for

Q96: Goolsbee, Inc., a U.S. corporation, generates

Q99: Robin Corporation distributes furniture basis of $40,000;

Q120: A new affiliate uses the LIFO method

Q144: Disproportionate distribution<br>A)Cash basis accounts receivable, for example.<br>B)Fair

Q152: The starting point in computing consolidated taxable

Q154: The inside basis is defined as a

Q158: Midway through the current tax year, Georgie