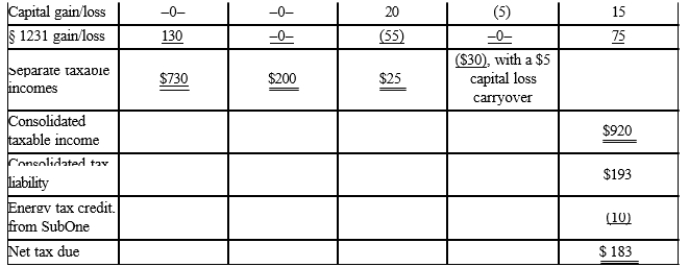

The Parent consolidated group reports the following results for the tax year. Determine each member's share of the consolidated tax liability, assuming that the members all have consented to use the relative tax liability tax-sharing method. Dollar amounts are listed in millions, and a 21% income tax rate applies to all of the entities.

Definitions:

Final Goods

Products that are consumed by the end user and do not require further transformation or inclusion in the production of other goods.

Hamburgers

A popular food item consisting of a cooked patty of ground meat, usually beef, placed inside a sliced bun, often served with various condiments and toppings.

Microeconomic Analysis

The study of the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms.

Macroeconomics

The branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole, rather than individual markets.

Q4: How does the definition of accumulated E

Q38: Rate used to determine the § 382

Q44: ParentCo owns all of the stock of

Q50: What are the requirements that must be

Q57: Forming a Federal consolidated tax return group

Q59: Consolidated estimated tax payments must begin for

Q66: Pheasant Corporation, a calendar year taxpayer, has

Q101: Tammy forms White Corporation in a transaction

Q133: Section 721 provides that, in general, no

Q148: Limited partner<br>A)Includes the partner's share of partnership