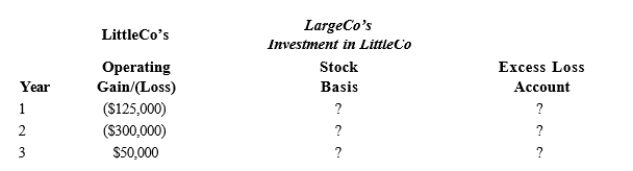

LargeCo files on a consolidated basis with LittleCo. The subsidiary was acquired for $400,000 on January 1, year 1, and it paid a $75,000 dividend to LargeCo at the end of both year 2 and year 3.

a. Given the following information about the subsidiary's operating results, derive the requested amounts as of

December 31 of each year. The group files using a calendar year.

b. LargeCo sold LittleCo to an unrelated competitor for $600,000 on December 31, year 3. How will LargeCo account for this sale?

Definitions:

Population Size

The number of individuals within a specific species living in a particular geographic area.

Monophyletic Clade

A group of organisms that includes an ancestor and all of its descendants, representing a single branch on the tree of life.

SIV Strain

A specific variant of the Simian Immunodeficiency Virus, which is a non-human primate virus closely related to the Human Immunodeficiency Virus (HIV).

Q3: Generally, when a subsidiary leaves an ongoing

Q10: What is a constructive dividend? Provide several

Q28: If a shareholder owns stock received as

Q31: Seoyun and Nicole form Indigo Corporation with

Q66: Section 482 is used by the U.S.

Q67: Parent owns 100% of a U.S. partnership

Q79: When is a redemption to pay death

Q87: The right to file on a consolidated

Q87: The use of § 351 is not

Q120: A new affiliate uses the LIFO method