In the current year, Parent Corporation provided advertising services to its 100% owned subsidiary, SubCo, under a

contract that requires no payments to Parent until next year. Both parties use the accrual method of tax accounting and a calendar tax year. The services that Parent rendered were valued at $250,000. In addition, Parent received

$20,000 of interest payments from SubCo. relative to an arm's length note between them.

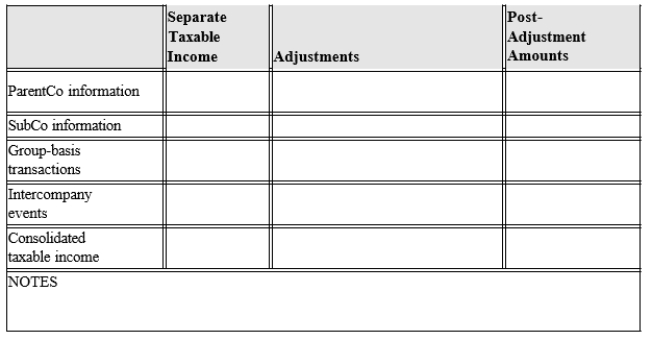

Including these transactions, Parent's taxable income for the year amounted to $400,000. SubCo reported $200,000 separate taxable income. Derive the group's consolidated taxable income using the format of Exhibit 8.3.

Definitions:

Retained Earnings

The segment of net profits that are not distributed as dividends, instead kept within the company for reinvestment in its main operations or for debt repayment.

Current Asset

A slightly different term for assets likely to be used or turned into cash within one fiscal year or operating cycle, emphasizing liquidity.

Land

An asset representing the earth's surface that a company owns, used for operations, development, or investment.

Liquidity

The ease with which an asset can be converted into cash without significantly affecting its price, reflecting a company's ability to meet short-term obligations.

Q16: Given the following information, determine whether

Q27: Xian Corporation and Win Corporation would like

Q35: Which of the following statements regarding the

Q39: The MOG Partnership reports ordinary income of

Q70: Which of the following statements regarding income

Q84: Dividends paid out of a subsidiary's E

Q114: To determine current E & P, taxable

Q116: Income of foreign person taxed through filing

Q149: With the filing of its first consolidated

Q150: George received a fully vested 10% interest