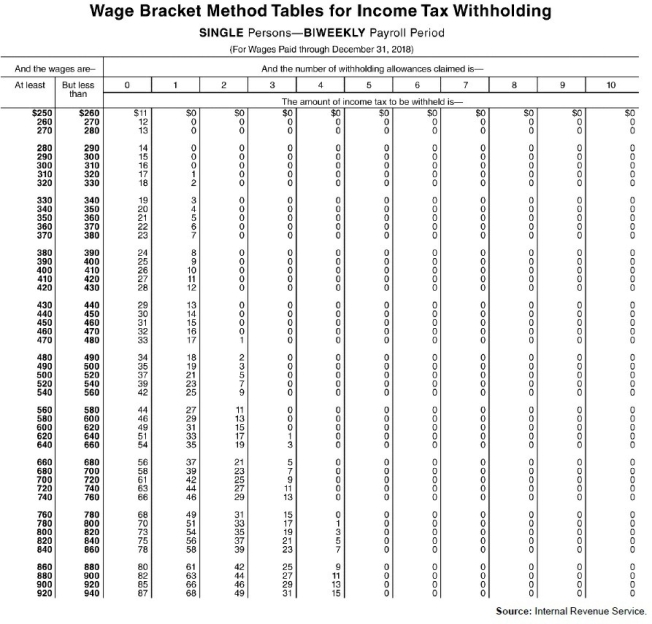

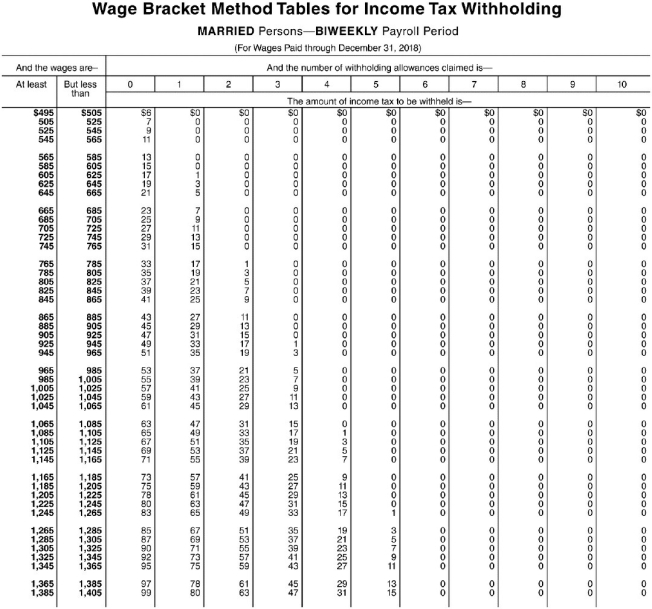

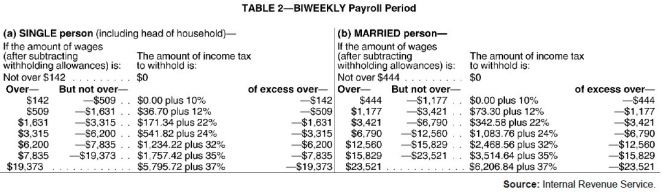

Exhibit 4-1:

Use the following tables to calculate your answers.

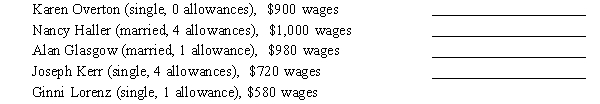

-Refer to Exhibit 4-1.Determine the income tax to withhold from the biweekly wages of the following employees wage-bracket):

Definitions:

Frequency of Payouts

Refers to how often employees receive their earnings, such as weekly, bi-weekly, monthly, or quarterly.

Bonus Allocation

is the distribution of financial rewards to employees beyond their regular pay, typically based on performance or company profit.

Gain Sharing

A performance-related pay strategy that offers employees financial rewards based on improvements in productivity, efficiency, or profitability within their work group or organization.

Higher Performers

Employees who consistently exceed job expectations and perform at levels beyond their peers.

Q1: Describe the differences between black and white

Q1: In recording the monthly adjusting entry for

Q5: The nurse must understand the unique actions

Q7: Always zero out the blade when using

Q7: Bouquet garni are flowers used as garnishes

Q8: The nurse is caring for a client

Q8: Pemmican is a Spanish word for salt

Q13: Food service workers should always wash their

Q25: The term "pantry" is derived from<br>A)cold kitchen.<br>B)sandwich

Q33: Which of thfollowing is truabout Gregor Mendel?<br>A)Mendel