Exhibit 10.1

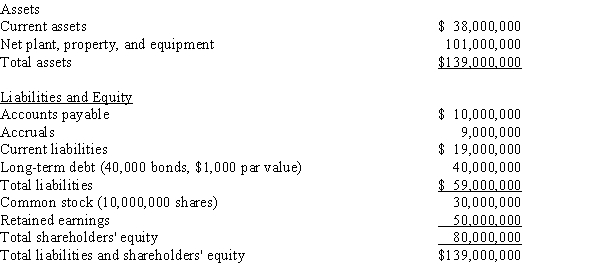

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 10.1.What is the best estimate of the firm's WACC?

Definitions:

Target Company

A company that is the object of a takeover by another firm, which may involve a merger, acquisition, or purchase of a significant portion of its shares.

Corporate Dissolution

The formal and legal process of dissolving or ending the existence of a corporation, which involves settling debts and distributing remaining assets.

Secretary of State

A high-ranking government official, often involved in foreign affairs or the head of a governmental department, depending on the country.

Deadlocked Corporation

A situation where the directors or shareholders of a corporation are unable to reach a consensus, halting decision-making processes.

Q2: A Treasury bond has an 8% annual

Q4: Which of the following statements is NOT

Q7: Which of the following statements is CORRECT?

Q11: If one British pound can purchase $1.98

Q14: Kollo Enterprises has a beta of 1.10,

Q22: The MacMillen Company has equal amounts of

Q31: A firm's capital structure does not affect

Q49: If the Treasury yield curve is downward

Q55: Aggarwal Enterprises is considering a new

Q76: When considering two mutually exclusive projects, the